Edmonton, Alberta | October 31, 2019

Highlights:

- Rental revenue was up 1% over Q3-2018 at $17.47 million; remained stable at $52.89 million year to date

- Net operating income grew 6% over Q3-2018 at $11.46 million; 3% to $33.85 million year to date

- Adjusted funds from operations (AFFO) increased 8% to $4.86 million or $0.17 per unit in the quarter; decreased 1% to $14.25

million or $0.51 per unit year to date - Occupancy increased to 90%

- Distributions of $0.05625 per trust unit were paid in July, August and September for a payout ratio of 97%

Melcor REIT (TSX: MR.UN) today announced results for the third quarter ended September 30, 2019. Rental revenue was stable compared

to the prior year. Net operating income increased 3% over the prior year to $33.85 million. AFFO was down 1% due to the increase in tenant

incentives and leasing commissions as we work to maintain occupancy under challenging market conditions.

Darin Rayburn, President & CEO of Melcor REIT commented: “I’m pleased to report to you on our third quarter results. We achieved stable

revenue and see new stability and positive momentum with leasing activity, which led to improved occupancy at the end of the quarter.

Throughout the quarter, we were again active in our unit buyback program as we believe that our unit price is not reflective of our current

or future prospects. Since April 1, 2019, we have purchased and cancelled over 53,000 units. The unit buyback program is part of our capital

allocation strategy.

Our pending acquisition is part of our thoughtful, targeted strategy to find great opportunities in our own back yard. Grande Prairie is a new

market that we’ve been looking to enter for an extended period of time. This acquisition will add 283,000 square feet to our portfolio gross

leasable area, increase our retail properties to 44% of our overall portfolio, and be immediately accretive to AFFO per Unit.

Over the past few years, we’ve continually adjusted to respond to market conditions while also focusing on operating efficiency, asset

enhancement and tenant retention. The future remains difficult to predict; however, the REIT remains well-positioned to manage efficiently

and build value for unitholders in our disciplined, conservative manner.”

Q3-2019 Highlights:

Our portfolio performance remained stable through the first nine months of 2019. Market fundamentals remain challenging; however, we

have started to see new stability and positive momentum with respect to leasing. We continue to proactively renew existing tenants and

pursue new tenants, which resulted in a healthy retention rate of 80.3% at quarter end and overall occupancy of 90.1%. The diversity of our

portfolio with respect to both tenant profile and asset class enable the REIT to continue navigating through economic cycles. We are focused

on the real estate fundamentals of asset enhancement and property management while conservatively managing our debt.

Highlights of our performance in the third quarter include:

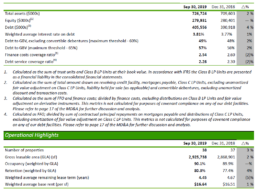

FINANCIAL HIGHLIGHTS

- Revenue was stable over Q3-2018 and Q2-2019, while net operating income (NOI) was up 6% in the quarter and up 1% over

Q3-2018 and Q2-2019 due to property acquisitions - Net income in the current and comparative periods is significantly impacted by non-cash fair value adjustments on investment

properties due to changes in capitalization rates/NOI and Class B LP Units due to changes in the REIT’s unit price. Management

believes funds from operations (FFO) is a better reflection of our true operating performance. FFO was $6.57 million or $0.23 per

unit, up 5% from Q3-2018 due to higher NOI. FFO was up 1% over Q2-2019. - Adjusted funds from operations (AFFO) was $4.86 million or $0.17 per unit, up 8% from Q3-2018. The increase was due to higher

FFO and lower straight-line rent adjustments. Compared to Q2-2019 AFFO was up 2% due to higher NOI. - As at September 30, 2019 we have $1.42 million in cash and $13.10 million in additional capacity under our revolving credit

facility. We conservatively manage our debt.

OPERATING HIGHLIGHTS

- Same-asset NOI was up 3% over Q3-2018 due to higher operating margins across every asset class and region, and stable sameasset

occupancy. This is the second quarter in a row that same-asset NOI is up over the prior period. - We continued to execute on our proactive leasing strategy to both retain existing and attract new tenants. We completed lease

renewals representing 124,211 sf (including holdovers) for a retention rate of 80.3% at September 30, 2019. New leasing has been

steady across the portfolio with 63,730 sf in new deals commencing to date in 2019 and an additional 48,000 sf committed for

future occupancy. - As part of a planned succession, Andrew Melton stepped down from his position of President and Chief Executive Officer on

October 1, 2019 with Darin Rayburn being appointed his successor. We thank Andrew for stepping into the role when needed and

look forward to his continued guidance as a member of our Board of Trustees.

CREATING UNITHOLDER VALUE

- We paid distributions of $0.05625 per trust unit in July, August and September for a quarterly payout ratio of 97% based on AFFO

and 72% based on FFO. We have maintained our distribution since inception, paying steady distributions to our unitholders for

seventy-six months. - On April 1, 2019 we commenced a normal course issuer bid (NCIB) which allows the REIT to purchase approximately 5% of our

issued and outstanding trust units for cancellation. We believe that our units have been trading in a price range which does not

reflect the value of the units in relation to our current and future business prospects. Under the NCIB, we have purchased 47,688

units for $0.36 million at a weighted average cost of $7.59 per unit or 77% of book value year to date. Subsequent to the quarter

we purchased an additional 5,816 units for $0.04 million.

SUBSEQUENT EVENT – ACQUISITION & FINANCING

- On October 10, 2019 we announced our intention to acquire a 283,235 sf regional shopping centre in Grande Prairie, Alberta from

a third-party for $54.8 million. This acquisition, expected to close on or about November 12, 2019, increases our portfolio GLA by

10% and is expected to be immediately accretive to AFFO per unit. Several other corporate events were announced

simultaneously:

– Our intention to partially satisfy the purchase price by issuing a 5.10% unsecured convertible debenture to raise $40

million and complete a private placement of Class B LP Units to Melcor Developments Ltd. for a minimum of $10 million

at an issue price equal to a 1.5% premium to the 5-day volume weighted average price of the REIT’s trust units

immediately prior to the closing of the acquisition.

– We intend to redeem our 5.50% unsecured convertible debentures that mature on December 31, 2019 with proceeds

from a new mortgage financing of approximately $35.6 million to be obtained on the acquired property post close. We

will provide a formal notice of redemption to holders once the new mortgage is in place. - On October 29, 2019 we announced the successful issue and sale of the 5.10% unsecured convertible debenture for gross

proceeds of $46.00 million, including $6.00 million for the exercise of the over-allotment option in full.

MD&A and Financial Statements

Information included in this press release is a summary of results. This press release should be read in conjunction with the

REIT’s Q3-2019 quarterly report to unitholders. The REIT’s consolidated financial statements and management’s discussion

and analysis for the three and nine-months ended September 30, 2019 can be found on the REIT’s website at

www.MelcorREIT.ca or on SEDAR (www.sedar.com).

Conference Call & Webcast

Unitholders and interested parties are invited to join management on a conference call to be held Friday, November 1, 2019 at

11:00 AM ET (9:00 AM MT). Call 416-340-2216 in the Toronto area; 1-800-377-0758 toll free.

The call will also be webcast (listen only) at http://www.gowebcasting.com/10256. A replay of the call will be available at the

same URL shortly after the call is concluded.

About Melcor REIT

Melcor REIT is an unincorporated, open-ended real estate investment trust. Melcor REIT owns, acquires, manages and leases quality retail,

office and industrial income-generating properties in western Canadian markets. Its portfolio is currently made up of interests in 38

properties representing approximately 2.93 million square feet of gross leasable area located across Alberta and in Regina, Saskatchewan;

and Kelowna, British Columbia. For more information, please visit www.MelcorREIT.ca.

Non-standard Measures

NOI, FFO, AFFO and ACFO are key measures of performance used by real estate operating companies; however, they are not defined by

International Financial Reporting Standards (IFRS), do not have standard meanings and may not be comparable with other industries or

income trusts. These non-IFRS measures are defined and discussed in the REIT’s MD&A for the quarter ended September 30, 2019, which is

available on SEDAR at www.sedar.com.

Forward-looking Statements:

This press release may contain forward-looking information within the meaning of applicable securities legislation, which reflects the REIT’s current expectations regarding future events. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the REIT’s control, that could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking information. Such risks and uncertainties include, but are not limited to, general and local economic and business conditions; the financial condition of tenants; the REIT’s ability to refinance maturing debt; leasing risks, including those associated with the ability to lease vacant space; and interest rate fluctuations. The REIT’s objectives and forward-looking statements are based on certain assumptions, including that the general economy remains stable, interest rates remain stable, conditions within the real estate market remain consistent, competition for acquisitions remains consistent with the current climate and that the capital markets continue to provide ready access to equity and/or debt. All forward-looking information in this press release speaks as of the date of this press release. The REIT does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise. Additional information about these assumptions and risks and uncertainties is contained in the REIT’s filings with securities regulators.

Contact Information:

Nicole Forsythe

Director, Corporate Communications

Tel: 1.855.673.6931

ir@melcorREIT.ca