Melcor REIT announces first quarter 2021 results

Highlights

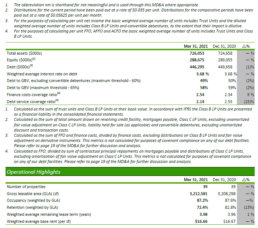

- Rental revenue was up 1% over Q1-2020 at $19.49 million

- Net operating income was up 6% over Q1-2020 at $12.63 million

- Adjusted cash flow from operations (ACFO) was up 16% to $5.75 million or $0.20 per unit over Q1-2020

- Occupancy was steady over Q4-2020 at 87.2%;

- Distributions of $0.035 per trust unit were paid in January, February and March for an ACFO quarterly payout ratio of 53%

Melcor REIT (TSX: MR.UN) today announced results for the first quarter ended March 31, 2021. Rental revenue was up 1% compared to the Q1-2020. Net operating income increased 6% to $12.63 million and ACFO was up 16% to $5.75 million or $0.20 per unit.

Darin Rayburn, President & CEO of Melcor REIT commented: “That our portfolio has continued to perform with stability throughout the COVID-19 pandemic is a testament to the purposeful diversity in our tenant base. Our neighbourhood shopping centres are comprised of many of the essential services that people rely on daily, including pharmacies, grocers, banks, gas stations, and fast food drive-throughs. Work from home orders remain in place wherever possible. The long-term impact on our office leases remains to be seen; however, we expect that the return to work will take place in some form when governments allow. We are pleased with the amount of rent we have received during the pandemic, collecting 98% of rent across office, retail, residential and industrial asset classes.

We continue to actively seek out programs to benchmark our energy use and actions to support the continued intentional reduction of our carbon footprint. In Q1-2021, we received ENERGY STAR certification for 2020 at our Fountain Tire Place building with a score of 88 out of 100, representing that the building is more energy efficient than 88% of similar buildings nationwide. We also joined and are active participants in the Edmonton Corporate Climate Leaders Program. We will continue to update unitholders on our ongoing Environment, Social Responsibility and Governance initiatives throughout 2021.

Lease renewals continue in 2021 and we completed 57,335 sf of lease extensions for a healthy retention rate of 72.4% at quarter end. In addition, new leasing has been active across the portfolio with 37,834 sf in new deals commencing to date in 2021 and an additional 55,000 sf committed for the future. Occupancy is slightly down at 87.2% and has held relatively steady throughout these challenging markets.

COVID case numbers are once again spiking in Alberta and additional measures, including the shutdown of indoor dining, have been put in place; however, most personal services and essential businesses remain open. We are hopeful that the ongoing rollout of vaccines while businesses shift to outdoor operations where necessary will allow our tenants to continue to perform through this third wave.

We worked diligently to support our tenants through the first two phases of COVID and will continue to do so. We believe that the strong relationships that we continually build with our tenants have been a key factor in minimizing the potential negative impact of COVID on our business.

Continued solidarity and partnership with our tenants will provide the best opportunity to endure the pandemic and be successful in the long-term.

We continue to actively monitor the situation, make thoughtful decisions and take action to come through this for the long-term success of all stakeholders.”

Q1-2021 Highlights:

Our portfolio performance remained stable through the three-months ended March 31, 2021 in spite of the COVID-19 pandemic continuing to hamper already challenging markets. While leasing activity has slowed as a result of the pandemic, we remained proactive in renewing existing tenants, resulting in a healthy retention rate of 72.4% at quarter-end. We also continue to pursue new tenant opportunities and had 37,834 sf in new deals commence to date in 2021. Occupancy dropped slightly to 87.2% compared to year end.

Highlights of our performance in the first quarter include:

FINANCIAL HIGHLIGHTS

- Revenue was stable at $19.49 million, with higher than normal other revenue due to $1.00 million in early lease termination fees from a tenant who had previously occupied 6,384 sf, contributing 0.4% towards 2020 base rent. This unusual other revenue was partially offset by lower recovery revenue and reduced straight-line rent. Net operating income (NOI) was up 6% in the quarter on account of higher other revenue.

- Net income in the current and comparative periods is significantly impacted by non-cash fair value adjustments on Class B LP Units due to changes in the REIT’s unit price. The change in unit price has a counter-intuitive impact on net income, as an increase in unit value decreases net income. Appreciation in our traded securities, with a 34% increase in the trading price of the REIT’s trust units compared to December 31, 2020, resulted in a $26.77 million loss on the valuation of our Class B LP Units. In the comparative period net income was also significantly impacted by fair value adjustments on investment properties due to changes in NOI/capitalization rates.

- Management believes funds from operations (FFO) is a better reflection of our true operating performance. FFO was $7.10 million or $0.24 per unit, compared to $6.73 million or $0.23 in Q1-2020, a direct result of higher NOI.

- ACFO was up 16% to $5.75 million or $0.20 per unit (2020 – $4.97 million or $0.17 per unit) due to increased FFO and lower straight-line rent adjustments. Management believes that ACFO best reflects our cash position and therefore our ability to pay distributions.

- As at March 31, 2021 we had $4.46 million in cash and $28.50 million in undrawn liquidity under our revolving credit facility.

OPERATING HIGHLIGHTS

- We continued to execute on our proactive leasing strategy to both retain existing and attract new tenants. We completed lease renewals representing 57,335 sf (including holdovers) for a retention rate of 72.4% at March 31, 2021. A further 129,795 sf of future 2021 renewals have been committed. New leasing has been steady across the portfolio with 37,834 sf in new deals commencing to date in 2021 and an additional 55,275 sf committed for future occupancy. While we continue to see pockets of opportunity, we anticipate the effects of the pandemic to continue to negatively impact the commercial leasing market.

CREATING UNITHOLDER VALUE

- On January 14, 2021 the Board approved a 17% increase in the monthly distribution, following a 47% reduction in our monthly distribution in April 2020. The increased distribution reflects improved business conditions, financial results and our outlook for 2021. We paid distributions of $0.035 per trust unit in January, February and March for a quarterly payout ratio of 53% based on ACFO and 43% based on FFO (2020 – 99% and 73% respectively).

- We reactivated our NCIB program in March 2021 following its suspension in May 2020. On April 1, 2021 we commenced a new NCIB. We are entitled to purchase up to 652,525 trust units for cancellation, representing approximately 5% of the REIT’s issued and outstanding trust units. The trust units may be repurchased up to a maximum daily limit of 3,824. The price which the REIT will pay for trust units repurchased under the plan will be the market price at the time of acquisition. The NCIB ends one year from commencement, on March 31, 2022. Year to date, we have repurchased a total of 81,859 units at a cost of $0.51 million.

SUBSEQUENT EVENT

- On April 15, 2021 we declared a distribution of $0.035 per trust unit for the months of April, May and June 2021. The April distribution is payable on May 17, 2021 to unitholders on record April 30, 2021. The May distribution is payable on June 15, 2021 to unitholders on record May 31, 2021. The June distribution is payable on July 15, 2021 to unitholders on record June 30, 2021.

MD&A and Financial Statements

Information included in this press release is a summary of results. This press release should be read in conjunction with the REIT’s Q1-2021 quarterly report to unitholders. The REIT’s consolidated financial statements and management’s discussion and analysis for the three-months ended March 31, 2021 can be found on the REIT’s website at www.MelcorREIT.ca or on SEDAR (www.sedar.com).

Conference Call & Webcast

Unitholders and interested parties are invited to join management on a conference call to be held May 5, 2021 at 11:00 AM ET (9:00 AM MT). Call 416-915-3239 in the Toronto area; 1-800-319-4610 toll free.

The call will also be webcast (listen only) at https://www.gowebcasting.com/11198. A replay of the call will be available at the same URL shortly after the call is concluded.

About Melcor REIT

Melcor REIT is an unincorporated, open-ended real estate investment trust. Melcor REIT owns, acquires, manages and leases quality retail, office and industrial income-generating properties in western Canadian markets. Its portfolio is currently made up of interests in 39 properties representing approximately 3.21 million square feet of gross leasable area located across Alberta and in Regina, Saskatchewan; and Kelowna, British Columbia. For more information, please visit www.MelcorREIT.ca.

Non-standard Measures

NOI, FFO, AFFO and ACFO are key measures of performance used by real estate operating companies; however, they are not defined by International Financial Reporting Standards (IFRS), do not have standard meanings and may not be comparable with other industries or income trusts. These non-IFRS measures are defined and discussed in the REIT’s MD&A for the quarter ended March 31, 2021, which is available on SEDAR at www.sedar.com.

Forward-looking Statements:

This press release may contain forward-looking information within the meaning of applicable securities legislation, which reflects the REIT’s current expectations regarding future events. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the REIT’s control, that could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking information. Such risks and uncertainties include, but are not limited to, general and local economic and business conditions; the financial condition of tenants; the REIT’s ability to refinance maturing debt; leasing risks, including those associated with the ability to lease vacant space; and interest rate fluctuations. The REIT’s objectives and forward-looking statements are based on certain assumptions, including that the general economy remains stable, interest rates remain stable, conditions within the real estate market remain consistent, competition for acquisitions remains consistent with the current climate and that the capital markets continue to provide ready access to equity and/or debt. All forward-looking information in this press release speaks as of the date of this press release. The REIT does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise. Additional information about these assumptions and risks and uncertainties is contained in the REIT’s filings with securities regulators.

Contact Information:

Investor Relations

Tel: 1.855.673.6931

ir@melcorREIT.ca

Information note:

Please note that the numerical information stated in press releases are outlined as-at the date of the press release.